Today, officials at the USDA will don their Santa Claus outfits a few months early and disburse almost $5 billion dollars in direct payment farm subsidies to landowners across the country.

The Direct Payments program, created in the 1990s to ease the government out of farm support programs, has instead become one of the nation’s costliest – and most ridiculous – entitlement programs.

While many checks will go to actual farmers, a significant number will go to trust funds, movie stars, millionaires, hedge funds and people who have done nothing more than fly over farms their entire lives.

Unable to justify the program any longer, even the farm lobbies and farmers admit they don’t need the payments and have largely agreed that the program should end with the next farm bill.

Congress’ failure to pass a new farm bill over the last couple of years, however, means that thousands of city slickers will once again receive millions of tax dollars – just days before food stamp benefits are scheduled to shrink. There has never been a better time to end direct payments – or a worse time to cut the standard benefit for the Supplemental Nutrition Assistance Program (SNAP).

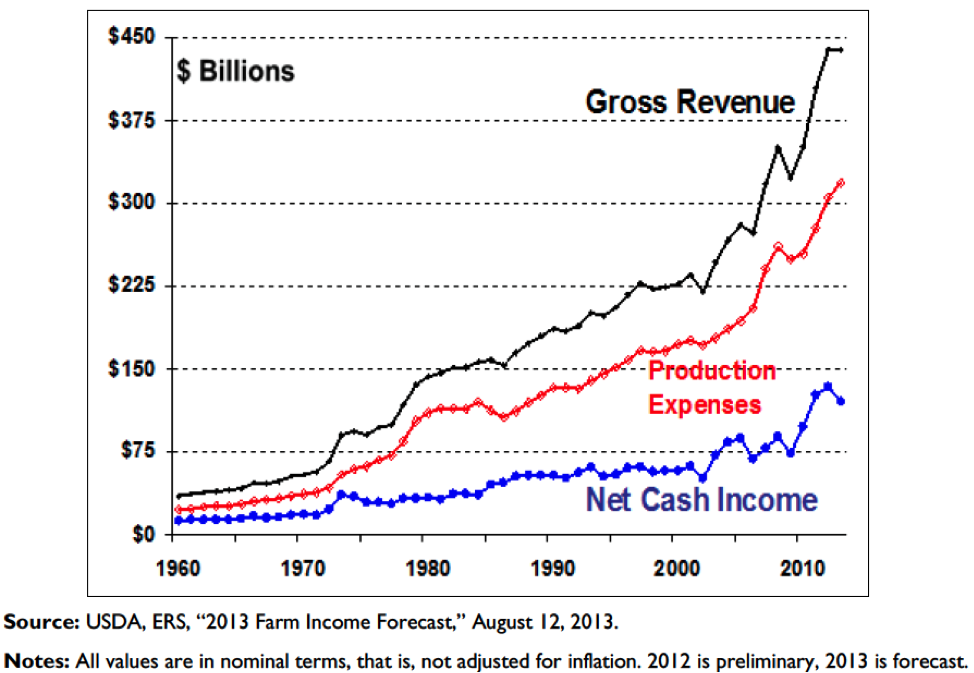

According to USDA’s Economic Research Service, gross revenues from farming operations nationwide have doubled over the last decade. Farmers’ net cash income, meanwhile, is now 2.5 times higher than it was 10 years ago.

US Farm Gross Revenue, Production Expenses and New Income

The federal study also found that the debt-to-asset ratio for farms, at 11 percent, is at its most favorable level ever, in part because the average value of cropland has almost quadrupled. According to the study, “Increases in farm asset values are expected to continue to exceed increases in farm debt, leading to expectations of another new record high for farm equity.”

Economic conditions for farmers are at historic highs by every measure, and they have more borrowing power than ever. Even small and medium-sized farms that once depended on direct payments to buy supplies and pay back loans are enjoying record net cash returns.

A recent study by Agrisolutions found that small grain operations working farms of between 1,000 and 2,000 acres had an average annual production margin (before rent) of $393 per acre on their corn fields from 2008 to 2012, about $43 per acre more than farms working larger spreads of 4,000 to 25,000 acres. Soybean growers working fewer than 1,000 acres earned an average annual profit of $323 per acre, versus $267 per acre for the biggest farms, a difference of $56 per acre every year.

Surprisingly, the study also found that the biggest farms didn't benefit from sizable discounts on their supplies or better crop marketing, as conventional wisdom assumes. In other words, smaller farmers aren’t at a disadvantage because of their size.

Direct payments, which average $604 a year apiece for more than 80 percent of the recipients, barely cover the cost of seed, fertilizer and fuel to farm two acres of corn. But multiplied by tens of thousands of recipients, they end up costing taxpayers more than any farm support program other than crop insurance subsidies. And, of course, they have done nothing to wean farmers off federal income support. In 2012 alone, taxpayers provided almost $30 billion in subsidies to farm businesses.

If Congress had passed a new farm bill before the old one expired in September, legislators could have saved taxpayers $5 billion this year by eliminating direct payments, a step that almost everyone agrees, and all the data confirms, is needed.

And even if none of that funding were rolled over into new programs, federal farm support programs in 2013 (including crop insurance subsidies) would still be three times as generous as they were when direct payments were created.

We should, of course, ensure that farmers with limited equity can acquire the seeds and materials they need to put a crop in the ground each year, whether or not the local bank will help. But there are better ways to accomplish that goal than by sending billions more dollars to non-farmers, millionaires and farmers who simply don’t need them. The better approach would be a targeted, low-interest loan program that serves those directly in need, and only those with a need.

Some argue that because the direct payments aren’t really needed, farmers are more likely to use them to implement good conservation practices. In fact, this has become the attitude of many landowners. But that’s not a reason to extend direct payments either. Instead, it’s yet another argument for restoring full funding to conservation support programs that yield targeted, measurable benefits for taxpayers.

When members of Congress convene the farm bill conference committee in the coming weeks, most expect that direct payments will finally come to a well-deserved end. They should have been eliminated a decade ago, though, and the USDA checks going out today are just one more round of unnecessary giveaways. There is absolutely no reason it should not be the last.