The so-called “prevented planting” component of the federal crop insurance program is wasting billions of dollars while encouraging growers to plow up wildlife-sustaining wetlands in the iconic Prairie Pothole Region of North and South Dakota.

“Prevented planting” crop insurance is supposed to compensate growers when extreme weather or other factors make it impossible to plant their crops. The program, however, has proved to be unworkable in the Prarie Pothole Region, despite repeated attempts by USDA’s Risk Management Agency to tighten the rules governing the coverage.

The reason is simple. The “potholes” in the aptly named region are actually seasonal wetlands that are wet or flooded in the spring but dry out in the summer or fall. Inability to plant these seasonal wetlands is the norm. As a result, the primary cause of loss that generates payouts is excess moisture, and the most payouts go to counties with the most seasonal wetlands – where “excess moisture” in springtime is entirely predictable.

Agency officials, have said publicly that at least one grower got payouts 17 years in a row. This is only a particularly egregious example of a system that makes no economic sense. As a result, payouts totaling billions of taxpayers’ dollars go out every year to a handful of counties. Between 2000 and 2013:

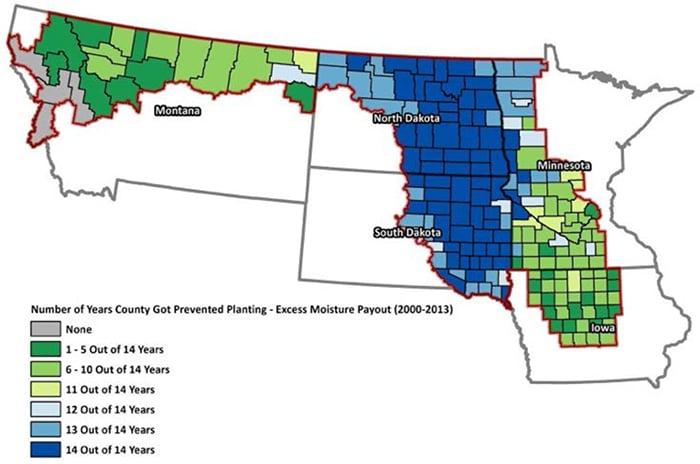

- The 195 counties in the region generated a whopping $4.9 billion in payouts for excessive moisture – 61 percent of all prevented planting payouts nationwide.

- Sixty-five counties – the dark blue area in the interactive map below – generated payouts for excessive moisture 14 years in a row and accounted for fully 69 percent of the $4.9 billion.

- Those 65 counties got more in prevented planting payouts than they did in so called "direct payments" – the most generous farm subsidy program during that period. As crop prices soared between 2007 and 2012, payouts were nearly double the direct payments.

- Another 29 counties had excessive moisture claims paid in 13 of the 14 years. Together, these 94 counties account for an astounding 90 percent ($4.4 billion) of all payouts due to excessive moisture in the region, and 55 percent of all such payouts nationwide.

The prevented planting provisions of the crop insurance program are operating more like an income support program than an insurance program for a handful of counties that encompass 69 percent of the total wetland area in the Prairie Pothole Region. This is truly bad news for taxpayers and the environment.

To its credit, USDA’s Risk Management Agency has tried repeatedly to refine the standards that loss adjusters must meet when determining whether a prevented planting payout should be made. The crux of the matter is determining whether the acreage on which a claim is being made can actually be planted under normal conditions or only when weather is abnormally dry. The agency issued new standards in 2006, 2011 and 2012, but those actions failed to stem the tide of payouts, and the pressure on the region’s critically important wetlands intensified.

In 2014, the agency issued yet another new standard to implement recommendations made by its inspector general. In short, only acreage that has been successfully planted in at least one of the previous four years will be eligible for prevented planting coverage. Once acreage fails that test, it must be successfully planted two years in a row before it can be covered again.

EWG analyzed weather data to evaluate the new standard and found that it will be very easy to pass the 1-in-4 years test. It will be much harder to pass the 2-in-2 years test, but it appears unlikely that many acres will ever have to meet that more stringent requirement. It seems likely that this new fix will also fail to stem the tide of payouts or blunt the incentives to plow out seasonal wetlands.

Moreover, the agency relies almost entirely on its approved insurance providers (AIPs) and the loss adjusters who work for them to apply and enforce the prevented planting rules. It is also dependent on growers to provide those adjusters with the documentation needed to evaluate claims.

As a result, the agency’s inspector general reported in 2013, “loss adjusters did not document and support a required determination related to prevented planting eligibility for any of the 192 prevented planting claims we reviewed.” Since 1999, Risk Management Agency’s Inspector General and the Government Accountability Office have repeatedly issued broad criticisms of the performance of crop insurance companies and their loss adjusters and questioned whether the agency has the capacity to effectively oversee their work.

The Risk Management Agency is saddled with trying to manage insurance coverage for excessive moisture in a region in which excessive moisture in springtime is the rule, rather than the exception. Rather than trying yet again to tighten its loss adjustment standards to manage an unworkable program, the agency should engage the private sector to develop insurance products – unsubsidized by taxpayers – for growers who want and are willing to pay an actuarially sound premium. The weather-based insurance developed by the Climate Corporation, for example, would be a good model to follow.

If the government continues to subsidize excessive moisture coverage in the region, the Risk Management Agency will have to dramatically strengthen its loss adjustment standards and its capacity to enforce those standards to avoid the worst abuses.

Denying coverage on acreage that has repeatedly generated payouts would be the most straightforward and easily enforceable standard. Such a standard would be grounded in the basic principles of insurance and be in keeping with at least some official interpretations of the statute that authorizes prevented planting coverage.

Congress made it impossible for EWG to evaluate the likely impact of such a standard by imposing a veil of secrecy on records of individual federal crop insurance policies and policyholders.

The abuses of this troubled program in the Prairie Pothole Region could be reduced by beefing up the agency’s capacity to utilize weather data, state-of-the-art remote sensing and additional data management tools, and by strengthening its on-the-ground compliance staff in order to oversee the work of crop insurance companies and adjusters.

On balance, however, the best option for taxpayers and the environment would be to put an end to federally subsidized prevented planting coverage for excessive moisture in the Prairie Pothole Region and to look to the private sector for innovative and affordable solutions for farmers wishing to grow crops in this unique and important landscape.

Introduction

"Prevented planting" is a component of the federal crop insurance program that is supposed to compensate growers when extreme weather or other factors make it impossible to plant their crops. Farmers can file claims when certain circumstances – excessive moisture (too much rain or snow), drought, flooding, cold wet weather, heat or the failure of an irrigation supply – keep them from planting their crop. The "prevented planting" coverage is part of underlying insurance policies that pay out whenever bad weather or falling crop prices result in growers' yield or revenue falling below the policies' guaranteed level.

Congress made prevented planting coverage a basic part of crop insurance policies in the Federal Crop Insurance Reform Act of 1994. It went into effect in 1995 and is administered by the U.S. Department of Agriculture.

USDA's Risk Management Agency (RMA) operates the program through arrangements with private companies, called approved insurance providers (AIPs), that sell and service the policies. The crop insurance program is heavily subsidized by taxpayers, which means growers pay far lower premiums than they would if the insurance worked the same as auto, home, health or other insurance sold by the private sector. The Risk Management Agency also pays the companies for the administrative costs of selling and servicing the policies, further lowering the premiums paid by growers.

A farmer files a claim by notifying the insurance company that he was unable to plant. The company then assigns a loss adjuster who is responsible for determining whether the acreage that couldn't be planted is eligible for a payout. The adjuster must consider a complicated set of criteria. The two most important are whether the acreage could be planted and harvested under normal conditions and whether other growers in the area were also unable to plant.

In 1999, just four years after prevented planting coverage became available, the Risk Management Agency's inspector general issued a scathing report. It found that:

- The program lacked sufficient controls to prevent abuse.

- 43 percent of the claims reviewed should not have been paid.

- Loss adjusters often had conflicts of interest with the growers whose claims they were evaluating.

In 2013, the Office of Inspector General issued another report that showed that the problems with prevented planting coverage had persisted despite the agency's efforts to tighten controls over the decisions made by loss adjusters.

EWG decided to look more closely at prevented planting coverage to answer two important questions:

- Do the payouts encourage growers to plow up critically important wetlands in the Prairie Pothole Region?

- How much of the billions of dollars paid on prevented planting claims goes for acreage that is not and should not be eligible for coverage?

This report summarizes what we found.

Big Payouts Go To a Handful of Counties Year After Year

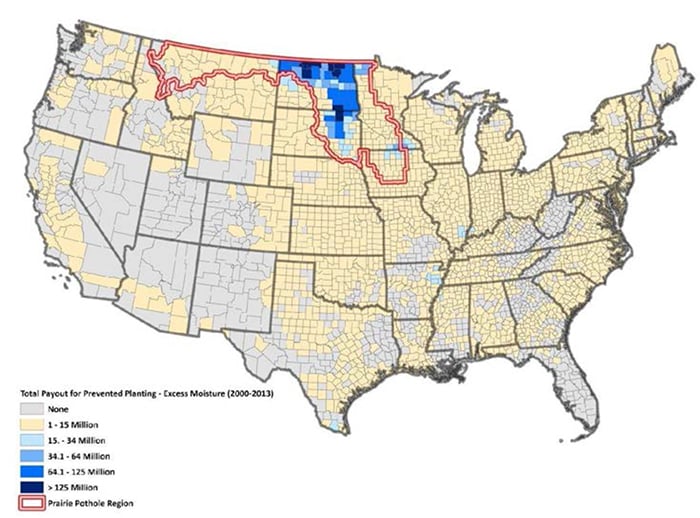

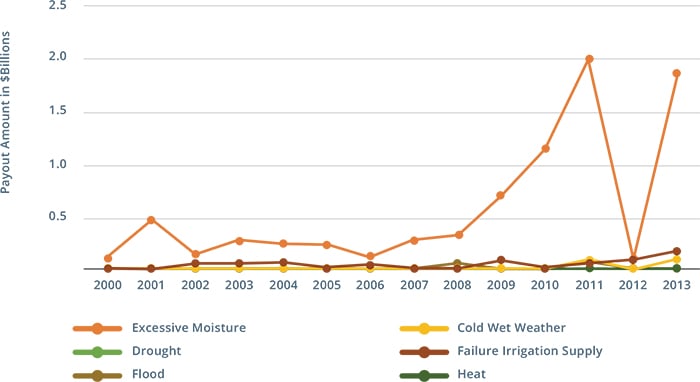

In insurance jargon, the "insured causes of loss" that can result in prevented planting payouts include any of the following: cold wet weather, drought, irrigation supply failure, flooding, extreme heat and excessive moisture. But records show that excessive moisture is almost the only reason ever cited for payouts. (Figure 1)

FIGURE 1: EXCESSIVE MOISTURE DWARFS ALL OTHER CAUSES OF PREVENTED PLANTING PAYOUTS.

Source: USDA Risk Management Agency, Cause of Loss Historical Data Files

No less than 87 percent of all prevented planting payouts between 2000 and 2013 were for excessive moisture, and most went to a handful of counties in the Prairie Pothole Region (PPR), which is famous for its thousands of shallow wetlands interspersed amid cropland and grassland.

Prevented planting payouts for excessive moisture are concentrated to a remarkable degree in a handful of counties in the Prairie Pothole Region. The payouts go out year after year to the same counties and the same handful of farm operations (Figure 2). Moreover, the payouts are huge, especially since the crop price boom that began in 2005. In many years, the moisture-related payouts greatly exceeded payments through so-called direct payment subsidies, which were the most important farm income support program from 1996 to 2014.

FIGURE 2: BIG PAYOUTS GO TO A HANDFUL OF COUNTIES

Source: USDA Risk Management Agency, Cause of Loss Historical Data Files

From 2000 through 2013, the 195 counties in the Prairie Pothole Region accounted for fully 60 percent of all policies (473,833 of 787,510) that generated excessive moisture payouts. They totaled a whopping $4.9 billion, 61 percent of the $8 billion in excessive moisture claims paid over that period.

This means that 9 percent of the 2,191 counties that generated excessive moisture payouts got 61 percent of total dollars paid and accounted for 60 percent of the policies that generated payouts.

A still closer look reveals that the size and concentration of payouts for prevented planting due to excess moisture are even more astonishing.

Payouts 14 Years in a Row

From 2000 to 2013, 65 counties – the dark blue area in Figure 3 – generated payouts for excessive moisture 14 years in a row. These counties – 30 in North Dakota, 30 in South Dakota and five in Minnesota – accounted for fully 79 percent of the policies that paid claims in the Prairie Pothole Region and fully 69 percent of the total amount paid.

Even more strikingly, the counties that collected 69 percent of the payouts were home to only 27 percent of the farms in the region.

Another 29 counties had excessive moisture claims paid in 13 of the 14 years, accounting for 21 percent of all payouts in the region. Together, these 94 counties account for an astounding 90 percent of all payouts due to excessive moisture in the region and 55 percent of all such payouts nationwide.

Growers in those 94 counties also accounted for 94 percent of all policies generating moisture-linked prevented planting claims in the region (Figure 4).

FIGURE 3: 65 COUNTIES (DARK BLUE AREA) IN THE PRAIRIE POTHOLE REGION COLLECTED PREVENTED PLANTING PAYOUTS FOR EXCESSIVE MOISTURE EVERY SINGLE YEAR FROM 2000 TO 2013.

Click map below to see county by county details.

Source: USDA Risk Management Agency, Cause of Loss Historical Data Files

Prevented Planting Payouts Send Billions to a Handful of Counties

The prevented planting provisions of the federal crop insurance program are a remarkably generous boon for a handful of counties in North and South Dakota.

Total payouts due to moisture in the 65 counties that got payouts every year from 2003 to 2012 totaled $2.6 billion. That’s slightly more than the $2.5 billion that went to those counties as direct payments – the most generous farm subsidy program during that period. The payout total was only about a third of the amount of direct payments before the boom in crop prices, which drove up the claims amounts dramatically. From 2003 to 2006, prevented planting payouts totaled $373 million, while direct payments were $1.2 billion. Between 2007 and 2012, however, the payouts were nearly double the direct payments -- $2.2 billion compared to $1.3 billion.

"In crop years 2006-08, for example, RMA records show crop insurance paid more than $400 million of claims on acreage with 'normal' weather patterns in the Dakotas and Minnesota. 'We have documented cases of policyholders not able to plant wetlands for up to 17 consecutive years and collecting an indemnity,' another agency official said in a background interview with DTN. In fact, approximately 1,300 growers had made prevented planting claims for at least 10 consecutive years, and another 2,200 for at least five years.

Marcia Zarley Taylor

DTN-Progressive Farmer, May 13, 2013

In many counties, prevented planting payouts for excess moisture account for nearly all crop insurance claims year after year. For example, they were 70 percent of all crop insurance payouts in Bottineau County, 67 percent in Ransom County and 66 percent in Burke County, all in North Dakota.

Two counties – Brown, South Dakota, and Ward, North Dakota – illustrate just how generous the payouts are. From 2000 to 2013, Brown County harvested more than $270 million in moisture-related prevented planting payouts, while Ward collected almost $200 million. The average county payout in the Prairie Pothole Region over the period was a comparatively tiny $26 million. Even before the spike in crop prices, payouts in Brown County totaled $47 million, 30 percent more than the direct payments to growers there.

As crop prices began to climb between 2007 and 2013, payouts soared to seven times the $32 million in direct payments in Brown County and four times the $46 million in Ward. Average payouts rose from $34/ acre to $63/acre in Brown County, and from $20/acre to $42/acre in Ward.

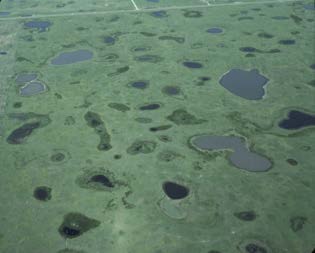

Planting Crops in Wetlands

Seasonal wetlands dominate the Prairie Pothole Region, as seen in this aerial view.

Seasonal wetlands dominate the Prairie Pothole Region, as seen in this aerial view.

The reason prevented planting payouts are concentrated in the Prairie Pothole Region is simple – growers are trying to plant crops on land that is too wet in the spring, even when the weather is normal.

The "potholes" in the aptly named region are actually seasonal wetlands that are wet or flooded in the spring but dry out in the summer or fall.

Inability to plant these seasonal wetlands in the springtime is the norm. As a result, the primary cause of loss that generates payouts is excess moisture, and the most payouts go to counties with the most seasonal wetlands – where "excess moisture" in springtime is entirely predictable.

Wetland Destruction

Farmers seeking to plant seasonal wetlands in the Prairie Pothole Region are the overwhelming beneficiaries of prevented planting crop insurance payouts. This is bad news for the U.S. Treasury and for these ecologically important wetlands.

The moisture-triggered payouts are so big and so frequent that they create powerful incentives for landowners to keep plowing up seasonal wetlands. Growers have little to lose since payouts are nearly guaranteed, covering any losses they might incur if it's too wet to plant. In fact, the 2013 Inspector General's audit concluded that the payouts likely overcompensate growers. The audit found that the payouts were historically higher than farmers' pre-planting expenses for seed, fertilizer and other requirements.

As a result, prevented planting insurance poses a grave risk to wetlands in the critically important region. More than 50 percent of North America's breeding waterfowl depend on these seasonal wetlands, and 40 species make their home in the Prairie Pothole region. In spring, the wetlands also retain water that could otherwise make flooding worse downstream, and they help recharge aquifers that supply water to the area's farms and people.

Repeated plowing of seasonal wetlands in late summer or fall rips out wetland vegetation and shrinks the size and depth of the wetland over time. Soil erosion from adjacent cropland increases and the wetlands fill up with mud much faster than they would otherwise. Water levels in farmed seasonal wetlands become more variable, degrading their value as habitat and their capacity to prevent floods.

More troubling – but hardly surprising – is that seasonal wetlands are concentrated in the counties that receive the most prevented planting payouts for excess moisture. The 65 counties that got payouts every year from 2000 to 2013 encompass fully 46 percent of the total wetland area in the Prairie Pothole Region, according to the U.S. Fish and Wildlife Service's National Wetlands Inventory. Add the 29 counties that got these payouts in 13 of the 14 years and the percent of wetland area jumps to 69 percent.

In 2013, EWG's "Going, Going, Gone" report documented a disturbingly high rate of converting wetlands and associated habitat to cropland in the region between 2008 and 2012. The 65 counties that got prevented planting payouts every year between 2000 and 2013 were in most cases the same ones that were hotspots for the wetland conversion documented in the report. (Click here to see a map of wetland conversion hotspots.)

This is truly bad news for taxpayers and the environment.

"To understand why a farmer would destroy a wetland, you need to understand something about crop insurance. Many shallow ponds and marshes are classified under federal regulations as ‘farmed wetlands.' They can't be drained, but they can be farmed if they're dry, and many are right now.

"Ephemeral wetlands might not seem like the best place to grow corn, but a return on the investment is guaranteed. If a farmer can get seed into the ground and corn grows, the return is obvious, especially with prices hovering near $8 a bushel.

"If the crop fails because, say, the wetland fills up in the spring, the farmer can claim the loss under federal crop insurance, potentially for several years."

Dave Orrick:

"Changes Ahead for South Dakota Pheasant Hunting"

St. Paul Pioneer Press, Dec., 10, 2012

Attempted Fixes Have Failed

To its credit, USDA's Risk Management Agency has tried repeatedly to refine the standards that loss adjusters must meet when determining whether a prevented planting payout should be made. The agency must rely on loss adjusters to apply these standards and to secure the documentation needed to ensure that prevented planting payouts are made only on acreage that can be planted when the weather is normal.

The crux of the matter is determining whether seasonal wetlands should be insurable in the first place, let alone eligible for a prevented planting payout. In insurance jargon, this boils down to determining whether the acreage is "physically available for planting" under normal conditions.

The agency first tried to tighten the definition of "physically available for planting" in its Prevented Planting Loss Adjustment Standards Handbook (PLASH) for the 2006 crop year, which excluded "acreage that in normal weather patterns is normally wet throughout the final and late planting period and that would only be available to plant in abnormally dry conditions." It added that acreage that is normally wet from year to year "is likely to have well-established cattails, perennial weeds, and perennial grasses that increase the likelihood of the acreage being unavailable for planting even in the driest year." In February 2012, RMA issued a Final Agency Determination (FAD-110) that upheld the 2006 provisions, stating: "Normal weather conditions are not a covered cause of loss."

In its PLASH for the 2011 crop year, the agency tried to further refine and clarify the definition – specifying that acreage that has or recently had marsh vegetation was not insurable. The new standards reiterated that acreage that was normally wet during the planting period and "would only be available to plant in abnormally dry conditions" could not be considered "physically available for planting." Moreover, the new document recognized that acres that are too wet to plant in the spring but might be dry enough to till or plant in the fall could not be considered insurable in the spring – and therefore were not eligible for a prevented planting payout due to excess moisture.

In 2012, the agency began issuing so-called Special Provisions that were specific to the Prairie Pothole Region and sought to further tighten the definition of acres that could be considered physically available for planting. In January 2014, RMA issued another Final Agency Determination (FAD-201) that upheld the 2012 definition and added: "If the approved insurance provider establishes that the only time the acreage is available for planting is when the area is abnormally dry, then the acreage is not eligible for prevented planting."

The agency has issued dozens of bulletins and Final Agency Determinations in addition to the list above in its attempt to ensure the integrity of prevented planting coverage

Still, the history of payouts in the region clearly demonstrates that, sadly, the agency's repeated attempts to clamp down on payouts on acres that are too wet to plant in normal conditions have not worked. The flow of cash to the same handful of North and South Dakota counties that have generated payouts year after year continues unabated, and the threat to critically important wetlands intensified when crop prices boomed.

"In 2012, an even more stringent prevented planting rule went into effect for five prairie pothole states – Minnesota, Iowa, North Dakota, South Dakota and Montana. The Risk Management Agency ruled that growers in those five states must plant and take a crop to harvest at least once every three years to be eligible for prevented planting the following year. (Some insurance company executives had complained privately that some insured fields 'had perch swimming on them.')

"In addition to that one-in-three rule, the acreage must also be 'insurable.' Acreage that under normal weather patterns is normally wet through the crop insurance final and late planting period – and that normally has cattails and perennial weeds and grasses growing on it – would not qualify. That could potentially disqualify some Dakota cropland that was planted thanks to 2012's extreme drought.

"What officials said they wanted to correct were repeated claims on wetlands RMA considers farmable only under abnormally dry conditions."

Marcia Zarley Taylor

DTN-Progressive Farmer, May 13, 2013

New Fix Likely Won’t Work

In its PLASH for 2014, the agency made another major change in its approach in order to implement recommendations made by its Inspector General in the 2013 audit. The audit concluded that using "normal" weather as a condition for meeting loss adjustment standards was "unworkable because it is too subjective for loss adjusters to apply in a uniform manner." The agency had not provided a definition or a methodology for determining whether the weather was normal during the planting period. Specifically, the report concluded: "Without a definition for ‘normal' weather and a methodology for determining if the claimed acres were planted when weather conditions were ‘normal,' loss adjusters do not have a clear standard to apply when making available-for-planting determinations."

The Inspector General's office recommended that the Risk Management Agency abandon references to "normal" weather and instead require acres to have been planted at least once every three or four years in order to be considered "physically available for planting." Its report went on to suggest any acres that failed the 1-in-3 or 1-in- 4 test "must be planted for a set number of consecutive years before regaining eligibility."

The agency's new rules exactly implement the Inspector General's recommendation for acreage insured in four Prairie Pothole states: Minnesota, Montana, North Dakota and South Dakota. The critical provisions in the new definition are (italics added):

In order for acreage to be "physically available for planting" in accordance of section 17(f)(8) of the Basic Provisions, the acreage must: (1) Be free of trees, rocky outcroppings, or other factors that prevent proper and timely preparation of the seedbed for planting and harvest of the crop in the crop year; … (5) In at least one of the four most recent crop years immediately preceding the current insured crop year, have been planted to a crop:

- a) Using recognized good farming practices;

- b) Insured under the authority of the Federal Crop Insurance Act (Act); and

- c) That was harvested, or, if not harvested, was adjusted for claim purposes under the authority of the Act due to an insured cause of loss (other than a cause of loss related to flood or excess moisture).

Once any acreage does not satisfy the criteria set-forth within 5 (a)(b) and (c) in one of the four most recent crop years immediately preceding the insured crop year, such acreage will be considered physically unavailable for planting until the acreage has been planted to a crop in accordance with (a)(b) and (c) above for two consecutive crop years.

In short, the agency's 2014 policy established two tests that acreage must meet to be considered physically available for planting and therefore eligible for a prevented planting payout:

- A 1-in-4 Years Test, which specifies that the acreage must have been planted, harvested or compensated for a claim (other than for excessive moisture or flooding) in at least one of the previous four years.

- A 2-in-2 Years Test, which specifies that acreage that fails the first test must be planted, harvested or compensated for a claim (other than for excessive moisture or flooding) two years in a row before it can again become eligible for a prevented planting payout.

To evaluate how well these new tests will work to prevent repeated payouts on acreage that should not be eligible, EWG undertook a study of weather data from the region.

1-in-4 Years Test Is Too Liberal

The 1-in-4 years test is the most important. As long as acreage meets that requirement, it remains eligible for a prevented planting payout. EWG analyzed the federal Palmer Drought Index to estimate how easy it would be for acreage in the Prairie Pothole Region to meet the rule. The Palmer Drought index is compiled by NOAA's National Climatic Data Center and records cumulative dry or wet conditions in 344 climate divisions in the lower 48 states. Twenty-seven of those divisions include land in counties of the Prairie Pothole Region.

To assess how likely it was that seasonal wetlands could have been planted under the 1-in-4 year test, EWG analyzed the Palmer Index to see how often conditions were drier than normal in May and June between 2000 and 2014. We then calculated the probability, expressed as a percent, that acreage in each climate division would have been dry enough to plant in at least one year out of the four (Table 1). EWG also assessed a 1-in-3 years test, which was what the Risk Management Agency initially proposed before settling on the 1-in-4 years test.

TABLE 1: NUMBER OF CLIMATE DIVISIONS BY PROBABILITY (PERCENT) THAT ACREAGE WOULD HAVE MET A 1-IN-4 OR 1-IN-3 YEARS TEST

| Number of Climate Divisions | ||||

|---|---|---|---|---|

| Probability of Meeting Tests | Prairie Pothole Region | 65 Counties | ||

| May | 1 in 4 years | 1 in 3 years | 1 in 4 years | 1 in 3 years |

| 0-24% | 0 | 0 | 0 | 0 |

| 25-49% | 0 | 1 | 0 | 1 |

| 50-74% | 2 | 10 | 1 | 5 |

| 75-100% | 25 | 16 | 12 | 7 |

| June | 1 in 4 years | 1 in 3 years | 1 in 4 years | 1 in 3 years |

| 0-24% | 0 | 0 | 0 | 0 |

| 25-49% | 0 | 4 | 0 | 4 |

| 50-74% | 5 | 8 | 4 | 3 |

| 75-100% | 22 | 15 | 9 | 6 |

| Average | 1 in 4 years | 1 in 3 years | 1 in 4 years | 1 in 3 years |

| 0-24% | 0 | 0 | 0 | 0 |

| 25-49% | 0 | 2 | 0 | 2 |

| 50-74% | 2 | 8 | 2 | 3 |

| 75-100% | 25 | 17 | 11 | 8 |

Source: NOAA National Climatic Data Center, U.S. Palmer Drought Indices

This analysis indicates it may be quite easy for acreage in the region to pass the 1-in-4 years test. There was a more than 50 percent probability that all climate divisions had drier than normal conditions in May or June between 2000 and 2014. In May, 25 out of 27 divisions had a more than 75 percent chance of passing the 1-in-4 years test, and in June, 22 out of 27 did. EWG also averaged the Index values for May and June and found the same result – it is very probable that drier than normal conditions will occur once in four years. Results from the 13 climate divisions that overlap the 65 Prairie Pothole counties mirror the results for the entire region.

Moreover, successfully planting acreage when the weather is abnormally dry now counts toward passing the 1-in-4 years test. This is a striking reversal of long-standing RMA policy and means that the millions of acres that could be planted in 2012 – a year of extreme drought – will now count toward meeting the 1-in-4 year test.

A 1-in-3 years test would lower the probability that acreage would qualify for payouts, but there are still a surprising number of climate divisions with a 75 percent chance of meeting that test's requirements.

2-in-2 Years Test Is Much More Restrictive

The Palmer Index data shows that it would be far harder for acreage in the Prairie Pothole Region to pass a 2-in-2 year test (Table 2). In 25 out of the 27 climate divisions, there is less than a 25 percent probability that weather in May would be drier than normal in two consecutive years. In June, the odds are similarly low in 21 out of 27 divisions. For the two-month average, 25 out of 27 divisions would have a less than 25 percent chance of being drier than normal two years in a row.

"Under the rule, for acreage to be eligible for prevented planting payments, the acreage must have been planted and harvested in one out of the last four years, regardless of whether one of those years was abnormally dry.

"‘The new rule is meant to apply a much more objective standard,' Willis said (Brandon Willis, RMA Administrator). He added that the previous policy required planting and harvesting to be done in a ‘normal year.' Under the new provision, that metric is broadened to make the means for determining eligibility more objective. For instance, if farmers planted and harvested in 2012 under ‘abnormally dry conditions,' they can now use that year in their eligibility for the program."

Agri-Pulse staff

RMA announces new prevented planting rule, Aug. 26, 2013

The weather data show that it would be even harder for acreage in the 65 counties that generated prevented planting payouts 14 years in a row to pass the test. All of the climate divisions in those 65 counties have less than a 25 percent chance of meeting the a 2-in-2 year test when Index values are averaged between May and June.

TABLE 2: NUMBER OF CLIMATE DIVISIONS BY PROBABILITY (PERCENT) THAT ACREAGE WOULD HAVE MET A 2-IN-2 YEARS TEST

| Number of Climate Divisions | ||

|---|---|---|

| Probability of Meeting Test | Prairie Pothole Region | 65 Counties |

| May | 2-in-2 Years | 2-in-2 Years |

| 0-24% | 25 | 13 |

| 25-49% | 2 | 0 |

| 50-74% | 0 | 0 |

| 75-100% | 0 | 0 |

| June | 2-in-2 Years | 2-in-2 Years |

| 0-24% | 21 | 13 |

| 25-49% | 5 | 0 |

| 50-74% | 1 | 0 |

| 75-100% | 0 | 0 |

| Average | 2-in-2 Years | 2-in-2 Years |

| 0-24% | 25 | 13 |

| 25-49% | 2 | 0 |

| 50-74% | 0 | 0 |

| 75-100% | 0 | 0 |

Source: NOAA National Climatic Data Center, U.S. Palmer Drought Indices

Top Two Counties

EWG took a closer look at weather data for the two counties – Brown County, South Dakota, and Ward County, North Dakota – that got the most prevented planting payouts for excess moisture between 2000 and 2013.

The National Climatic Data Center estimates "normal" weather data using a 30-year record of temperature, degree-days, precipitation, snowfall, snow depth, wind, etc. from weather stations across the country. The so-called weather "normals" are organized into hourly, daily, monthly, seasonal and annual figures.

The Center reports "normals" for six weather stations in Brown County and four in Ward County. EWG calculated normal annual precipitation for each station by adding the 12 monthly "normals." We then compared the annual normal to actual precipitation that year to determine how often the weather was drier than normal for each year from 2000 to 2013. Below-normal precipitation would suggest that seasonal wetlands were likely available for planting.

TABLE 3: PROBABILITY THAT WEATHER WILL BE DRIER THAN NORMAL IN BROWN AND WARD COUNTIES

| 1-in-4 years | 1-in-3 years | 2-in-2 years | |

|---|---|---|---|

| Brown County, S.D. | 91% | 85% | 40% |

| Ward County, ND | 98% | 90% | 38% |

Source: NOAA National Climatic Data Center, Global Historical Climatology Network

The results are striking. In Brown County there is a 91 percent probability that one in every four years will be drier than normal and an 85 percent chance that one in three will be. In Ward County there is a 98 percent chance that one in four years will be drier than normal and a 90 percent chance in one in three will be. There is a 40 percent probability that weather will be drier than normal in two consecutive years in Brown County, and a 38 percent probability of that in Ward County.

It is almost certain that growers in these two counties will always meet the 1-in-4-years test. In the rare case that they do not, there is still a good chance of meeting a 2-in-2-years standard and once again becoming eligible for prevented planting payouts in succeeding years.

RMA's Office of Inspector General said that its recommended approach – now fully implemented by the agency – would "prevent regularly wet land from becoming eligible, due to being planted in a single, abnormally dry year."

EWG's findings, however, indicate that the new policy will still allow prevented planting payouts for excess moisture year after year for seasonal wetlands that can only be successfully planted when the weather is drier than normal.

Insurance Companies in Charge

The Risk Management Agency must rely almost entirely on its approved insurance providers (AIPs) and the loss adjusters who work for them to apply and enforce the prevented planting rules and on growers to provide those adjusters with the documentation needed to adequately adjust his or her claim. Yet, the inspector general reported in 2013 that "loss adjusters did not document and support a required determination related to prevented planting eligibility for any of the 192 prevented planting claims we reviewed."

Since 1999 multiple audits by RMA's own Inspector General and the Government Accountability Office have contained broad criticisms of the performance of crop insurance companies and their loss adjusters and questioned whether RMA has the capacity to effectively oversee their work. Criticisms were leveled regarding performance in implementing the federal crop insurance program as a whole and specifically about the special problems created by prevented planting coverage.

For example:

- A 1999 Inspector General's audit of prevented planting payouts in 1996 concluded that claims were paid on "lakes, potholes, and riparian areas (stream beds and similar terrain) that were under water or idle during 1996 and the 4 previous years." The report blamed the improper payouts on "conflicting requirements concerning acreages eligible for payments" and "untimely and inadequate adjustments of claims by the reinsured companies which were generally months after the prevented plantings occurred."

- That 1999 audit cited two instances in which "loss adjusters who adjusted prevented planting claims for two of the insureds had conflicts of interest or close relationships with the insureds. In one case, two loss adjusters leased land to the insured and adjusted the 1996 prevented planting claims of the insured. In the second case, one loss adjuster was a first cousin of the insured."

- In a September 2005 audit, the Government Accountability Office wrote that "as RMA and company officials told us, it is often difficult to determine whether the producer had the opportunity to plant a crop, hampering their ability to hold down fraudulent claims."

- On May 3, 2007, Inspector General Phyllis K. Fong testified before the House Committee on Oversight and Government Reform that "we continue to believe that by assigning low overall risk to the AIPs, the AIPs have less incentive to administer the insurance policies in accordance with the Government's and taxpayers' best interest. That is to say, incentives are lacking for AIPs to effectively monitor risky policyholders, deny claims of questionable losses, and address inadequacies in their own practices. We concluded that the structural framework of the program had increased the risk or vulnerability to fraud, waste, and abuse."

- Fong also testified that her office found weaknesses in the companies' oversight, including "conflicts of interest among sales agents, loss adjusters, and/or policyholders; inadequate verification of losses and errors by the loss adjusters… and inadequate or nonexistent quality control processes by AIPs and RMA."

- A March 2012 GAO audit found that "RMA has made substantial progress over the past decade in developing data mining tools to detect and prevent fraud, waste, and abuse from a list of farmers who have received payments for anomalous claims, but RMA's use of these tools lags behind their development, largely because of competing priorities." Moreover, GAO found that USDA Farm Service Agency (FSA) field inspections of anomalous claims were often not completed, completed too late, not reported to RMA in a timely fashion and not reported to AIPs.

"Both the farmers and insurance companies are responsible for the abuses.

"'Some producers would cultivate in the fall, even if they knew they weren't going to plant, Hagel says (Doug Hagel, former RMA Regional Director, Billings, Mont.). 'Some of them would mow cattails, burn off sloughs, saying they were going to plant in the spring, but it was always too wet.' (Slough is another name for a wetland)

He says the small amount of prevent-plant payments made in 2008 were questionable because it was a drought year. He says 186,000 acres in North Dakota were prevented planting acres that year and were unplantable because they were 'on a slough' or wet acres.

Hagel says there have been arbitration cases in which companies have denied claims for farmers using questionable practices, only to have them overturned by arbitration cases, but he couldn't immediately offer details."

Mikkel Pates

AGWEEK, June 21, 2011

The Risk Management Agency has tried repeatedly to refine its guidance to the insurance companies and loss adjusters to ensure that prevented planting payouts are made only when the cause of a loss is truly unexpected and infrequent – not the natural state of the acreage on which a claim was made. However, the evidence from the government watchdog agencies and EWG's own analysis is clear. Without a much more robust compliance and quality assurance capability, it is unlikely that even the best guidance will stem the large annual prevented planting payouts to a handful of counties or the threats they pose to wetland resources and the environment.

"By law, however, Hoffmann (Tim Hoffman, RMA's Director of Products Administration and Standards Division) said that crop insurance is allowed only for two years for prevented plant acres, as determined by Congress.

"He pointed to one trouble spot in North Dakota where Devils Lake has been growing in size and flooding farmland for years because of high water and not enough natural drainage.

'"I had a farmer there say he pays the same taxes on the land and that it's some of his best land,' Hoffmann said. 'I know that, but you can't continue to pay on the same damaged carpet or bedroom year after year."'

Barry Amundson

Tri-State Neighbor, March 14, 2013

Conclusion

Prevented planting coverage for excessive moisture is simply unworkable in the Prairie Pothole Region, particularly in those counties where seasonal wetlands dominate the landscape. "Excessive moisture" is the normal and expected condition in this unique and important landscape.

Encouraging growers to plow through and plant seasonal wetlands is a disaster for taxpayers and the environment. The prevented planting payouts generated year after year in a handful of counties function more as another form of farm income support than as a sound insurance program. Billions of dollars have been wasted paying claims on acreage that shouldn’t be eligible for insurance in the first place, while threatening one of the most important remaining wetland landscapes in North America.

To its credit, USDA’s Risk Management Agency has tried since 2006 to clamp down on the excesses in the Prairie Pothole Region, but those efforts have failed to stem the tide of payouts and wetland degradation. EWG’s analysis of weather data suggests that the agency’s latest policy revision is also likely to fail.

Not surprisingly, the prevented planting option is popular among growers and their Congressional allies. It is unclear, however, why taxpayers should be expected to subsidize coverage for excessive moisture or why other growers should bear the burden of premium increases because of the unwarranted and very large prevented planting payouts that go out year after year.

Rather than trying yet again to tighten its loss adjustment standards to manage an unworkable program, the agency should engage the private sector to develop insurance products – unsubsidized by taxpayers – for growers who want and are willing to pay an actuarially sound premium. The weather-based insurance developed by the Climate Corporation, for example, would be a good model to follow.

If the government continues to subsidize excessive moisture coverage in the region, the Risk Management Agency will have to dramatically strengthen its loss adjustment standards and its capacity to enforce those standards to avoid the worst abuses.

Denying coverage on acres that have repeatedly generated payouts would be the most straightforward and easily enforceable step. Such a standard would be grounded in the basic principles of insurance and be in keeping with at least some official interpretations of the statute that authorizes prevented planting coverage.

Alternatively, EWG’s analysis of weather data suggests that a stand-alone standard that limits coverage to those acres that have been successfully planted two years in a row would better protect both taxpayers and wetlands.

Congress made it impossible for EWG to evaluate the likely impact of such a standard by hiding information about individual federal crop insurance policies and policyholders behind a veil of secrecy. The Risk Management Agency and/or its inspector general could and should take on that task and make its findings available to Congress and taxpayers as a first step toward more effective oversight of this coverage in the Prairie Pothole Region.

Following the recommendations of its inspector general, the agency abandoned any references to "normal" weather in its loss adjustment standards. The inspector general made its recommendation because RMA had not provided loss adjusters with a clear definition of normal weather and a methodology for determining whether weather was normal during the planting period.

Determining if acreage is physically available for planting when precipitation is above or below normal remains the crux of the problem. Weather data are increasingly robust and USDA has already made a substantial investment in developing a climate and weather system that assembles real-time data on precipitation for use in managing its crop insurance program. The National Climate Data Center uses 30-year precipitation records to publish estimates of what amount of precipitation is "normal" for a region. the Risk Management Agency could use these data to provide a consistent definition of normal precipitation and a methodology for making that determination as a way to bolster loss adjustment standards and as a compliance tool to strengthen oversight of the program.

Finally, a long string of external evaluations has made it clear that the Risk Management Agency needs, at a minimum, to increase its capacity to utilize weather data, state-of-the-art remote sensing and additional data management tools. It also needs to increase the size of its on-the-ground compliance staff in order to oversee the work of crop insurance companies and adjusters to improve implementation of this troubled program.

On balance, the best option for taxpayers and the environment would be to end federally subsidized prevented planting coverage for excessive moisture in the Prairie Pothole Region and look to the private sector for innovative and affordable solutions for farmers attempting to grow crops in this unique and important landscape.