The federal crop insurance program has come under attack for its increasing cost, environmental impacts and secrecy. But the farm lobby, the crop insurance industry and their political patrons maintain that despite its flaws, crop insurance is better, cheaper and less likely to lead to environmental harm than disaster programs.

The federal crop insurance program has come under attack for its increasing cost, environmental impacts and secrecy. But the farm lobby, the crop insurance industry and their political patrons maintain that despite its flaws, crop insurance is better, cheaper and less likely to lead to environmental harm than disaster programs.

The facts tell a very different story. Crop insurance actually costs billions of dollars more than disaster payments.

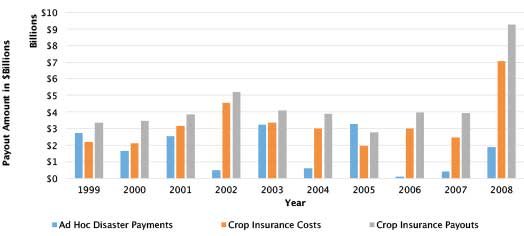

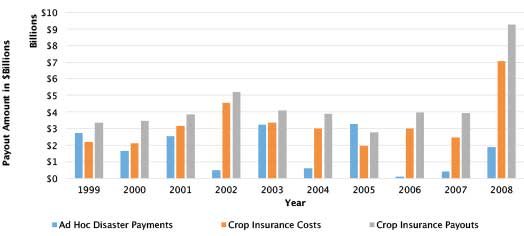

- From 1999 to 2008, in the six years Congress authorized large ad hoc disaster relief programs, farmers got about $15 billion in disaster payments, but more than $26 billion in crop insurance payouts.

- Crop insurance payouts went out year after year. Crop insurance payouts exceeded disaster payments in all of these years except 2005.

- After subtracting farmers’ share of the premiums and adding administrative costs, the net cost to taxpayers of crop insurance was almost $20 billion.

Crop insurance cost far more than ad hoc disaster payments.

Payouts to farmers from the crop insurance program have been far more generous than disaster payments because crop insurance policy deductibles are much smaller, the price at which losses are paid out is much higher and crop insurance guarantees crop prices in addition to crop yield. Adding salt to the wound, crop insurance actually exacerbates rather than reduces the incentives to plant on high-risk and environmentally sensitive land.

Crop insurance is not really insurance, but income support masquerading as disaster relief. Policymakers must cut through the myths spread by its champions and return crop insurance to a safety net taxpayers and the environment can afford.

Executive Summary

When you buy home or car insurance, you expect to collect only when there’s a disaster – a tornado, a hailstorm or a collision. If there was a policy that paid out year after year, you only had to pay less than half of the premium and you’d actually make money from buying it, you’d jump at it – but the insurer would be foolish.

That’s the deal more than a million farmers – including big, rich agribusinesses – are getting through the federal crop insurance program. And the insurer is the American taxpayer.

Crop insurance has largely replaced the ad hoc relief programs authorized by Congress in response to disasters. Crop insurance has come under attack for its increasing cost, environmental impacts and secrecy, but the farm lobby, the crop insurance industry and their political patrons argue that despite its flaws, crop insurance is cheaper and less likely to lead to environmental harm than disaster programs.

The facts tell a very different story. Crop insurance actually costs billions of dollars more than disaster payments.

EWG analyzed crop insurance and disaster payment data and reviewed scientific and economic studies of the two approaches to farm assistance. We found:

- From 1999 to 2008, in the six years Congress authorized large ad hoc disaster relief programs, farmers got about $15 billion in disaster payments, but more than $26 billion in crop insurance payouts. Crop insurance payouts exceeded disaster payments in all of these years except 2005. After subtracting farmers’ share of the premiums and adding administrative costs, the net cost to taxpayers of crop insurance was almost $20 billion, nearly a third larger than disaster payments.

- In all years between 1999 and 2008, ad hoc payments responding to disasters ranged from $105.2 million in 2006 to $3.3 billion in 2005. But crop insurance payouts went out year after year whether or not a disaster occurred. Crop insurance payouts never fell below $2.8 billion and peaked at $9.3 billion in 2008, almost three times larger than the highest year for disaster payments.

- Farmers had to lose more than 35 percent of their crop before qualifying for a disaster payment. Some crop insurance policies pay if farmers lose as little as 15 percent of their crop or revenue. Disaster programs paid out at a fraction of the actual market price for the crop – between 1990 and 2008, from 42 to 65 percent. But crop insurance policies pay out at the full market price, set when the policy is bought. For some policies the payout price can actually increase over the course of the growing season.

- Compared to disaster payments, crop insurance exacerbates rather than reduces incentives for farmers to grow on marginal and environmentally sensitive land. Situations that encourage harmful planting are more prevalent with crop insurance than they ever were with ad hoc disaster payments or standing disaster programs.

Crop insurance is not really insurance, but income support masquerading as disaster relief. Policymakers must cut through the myths spread by its champions and return crop insurance to a safety net that taxpayers and the environment can afford.

History of Disaster and Crop Insurance Programs

Crop insurance has largely replaced the ad hoc relief programs authorized by Congress in response to disasters. Crop insurance has come under attack for its increasing cost, environmental impacts and secrecy, but the farm lobby, the crop insurance industry and their political patrons argue that despite its flaws, crop insurance is cheaper and less likely to lead to environmental harm than disaster programs.

The facts tell a very different story. As shown by a review of the history of federal farm assistance, crop insurance actually costs billions of dollars more than disaster payments.

Federal disaster assistance has been dispensed to farmers through three main programs: emergency loans, disaster payments and crop insurance.

The Farmers Home Administration began providing emergency loans in 1949 to compensate for crop losses from natural disasters. The U.S. Department of Agriculture’s Farm Service Agency continues to provide disaster assistance through emergency loans.

The Agriculture and Consumer Protection Act of 1973 and the Rice Production Act of 1975 authorized a standing disaster payment program, which provided payments without the need for Congressional action in response to a specific disaster, and the program was reauthorized in the Food and Agriculture Act of 1977. The 1980 Federal Crop Insurance Act terminated the standing disaster payment program over concerns about its growing cost coupled with other criticisms of the performance of the program.

The 1980 act also increased taxpayer-funded subsidies for the premiums farmers paid for crop insurance – the first overt attempt to replace disaster payments with crop insurance payouts. Congress increased premium subsidies again in the 1994 Federal Crop Insurance Reform Act. Six years later, the Agricultural Risk Protection Act of 2000 nearly doubled the share of premiums paid by taxpayers and accelerated the shift to the revenue guarantee policies that dominate the program today. On average, taxpayers subsidize 62 percent of farmers’ crop insurance premiums.

Despite the dramatic increase in premium subsidies, Congress sent disaster payments to farmers through ad hoc disaster assistance measures in most years between 1995 and 2008.

In another attempt to end ad hoc disaster assistance Congress authorized a new standing disaster assistance program for crop producers called the supplemental revenue assistance payments program, or SURE, in the Food, Conservation and Energy Act of 2008. SURE paid farmers who experienced a loss in whole-farm revenue, meaning they only received a payment if their revenue from all crops on all their fields fell below a certain guaranteed level.

In addition to the SURE program, the 2008 Act also authorized four other standing disaster programs:

- LIP, the livestock indemnity program.

- LFP, the livestock forage disaster program

- ELAP, the emergency assistance for livestock, honeybees, and farm-raised fish.

- TAP, the tree assistance program.

Between 2010 and 2012, the SURE program cost $3.5 billion, and the high price tag prompted its removal in the Agriculture Act of 2014. The authorization of big ad hoc disaster bills disappeared after passage of the 2008 Act. LIP and the other standing disaster programs continue, largely for farmers producing livestock.

Congress has finally succeeded in replacing disaster programs with the federal crop insurance program. But the switch created a different kind of disaster – for taxpayers and the environment.

Crop Insurance vs. Ad Hoc Disaster Payments

Defenders of the crop insurance program argue that crop insurance still costs less than disaster payments. In a May 2015 issue of Agweek [http://www.agweek.com/crops/3795089-ag-returns-fire-insurance-opponents], for example, Senator Pat Roberts, the Chairman of the Senate Committee on Agriculture, Nutrition and Forestry, acknowledged that the current crop insurance program is expensive, but claimed insurance is less expensive than the “old” ad hoc disaster programs.

The numbers do not bear him out.

EWG used USDA payment and cost data assembled in our Farm Subsidy Database to compare the cost of crop insurance and disaster programs. In this analysis, payments from disaster programs mostly consist of agriculture payments made through ad hoc disaster bills, and payments made through the SURE program starting in 2010. Disaster payments, crop insurance payouts and crop insurance costs were adjusted for inflation and are reported in 2012 dollars.

We looked at two measures of the cost of crop insurance: the payouts made to farmers and the net cost of the program to taxpayers. The crop insurance payouts are the total indemnities paid to farmers through the federal crop insurance program each year. The net cost of crop insurance subtracts the amount of premium paid by farmers and adds in other costs of running the program. The share of policy premiums paid by taxpayers – the premium subsidy – makes up most of the net cost of the crop insurance program.

Large ad hoc disaster programs were enacted in 1999, 2000, 2001, 2003, 2005 and 2008. In those six years, the crop insurance program sent out $26.8 billion in payouts compared to $15.4 billion in ad hoc disaster payments. Crop insurance payouts exceeded disaster payments in all of these years except 2005. The net cost of crop insurance, $19.9 billion, was almost a third larger than disaster payments.

Between 1999 and 2008 ad hoc disaster payments varied greatly from year to year, ranging from $105.2 million in 2006 to $3.3 billion in 2005. But crop insurance payouts went out year after year whether or not a disaster occurred. Crop insurance payouts never fell below $2.8 billion in any of those years, and peaked in 2008 at $9.3 billion, almost three times larger than the highest year for disaster payments. The net cost of insurance in any year never fell below $2 billion and was higher than disaster payments in every year except 1999 and 2005 (Figure 1).

Figure 1: Crop insurance cost far more than ad hoc disaster payments.

Source: EWG, from 2012 Farm Subsidy Database

Since major ad hoc disaster payments were no longer provided after the 2008 farm bill, crop insurance payouts and the net cost of the program to taxpayers have soared as crop prices boomed and producers took advantage of the big bump in premium subsidies Congress mandated in 2000. Ad hoc disaster payments and SURE program payments totaled $4.3 billion between 2009 and 2012. Ad hoc disaster bills were still passed to address some local disasters, such as drought in California, but no major bills were passed after 2008. For 2009-2012, total crop insurance payouts were $35.4 billion and the net cost to taxpayers of crop insurance was $26.1 billion.

Disaster Assistance – or Income Support?

Passing ad hoc disaster assistance was a challenge for Congress, particularly after such programs could no longer be considered “off-budget.” But at least those payments only went out when a weather-related disaster occurred.

Crop insurance, however, has grown into an annual disaster program with payouts that are far more generous and more frequent than under the old regime of ad hoc disaster payments. The payouts are so generous and so frequent that they more resemble an income support program than a safety net for farmers facing serious financial losses because of bad weather. Payouts to farmers from the crop insurance program have been and still are far more generous than disaster payments because crop insurance policy deductibles are much smaller, the price at which losses are paid out is much higher and crop insurance guarantees crop prices in addition to crop yield.

Deductibles

Farmers had to lose at least 35 percent of their crop before qualifying for a disaster payment. Crop insurance policies will generate payouts if farmers lose as little as 15 percent of their crop or revenue. The average deductible for a corn insurance policy in 2013 was 26 percent and for soybeans 24 percent.

Prices

Disaster programs paid out at a fraction of the actual market price for the crop. Between 1990 and 2008, the price used to calculate a disaster payment ranged from 42 to 65 percent of the market price. In contrast, crop insurance policies pay out at the full market price, set when the policy is bought. In fact, under the most popular policies, the price at which the policy pays out can actually increase over the course of the growing season.

Revenue vs. yield

Crop insurance policies most favored by farmers guarantee per acre revenue rather than per acre yield, as disaster programs did. This means crop insurance policies are insuring against a drop in price as well as a loss in yield. The real impact of the differences between disaster payments and crop insurance payouts were made clear in the 2012 drought, which most people would consider a weather-related disaster. According to EWG’s “Taxpayers, Crop Insurance, and the Drought of 2012” report:

- Revenue crop insurance policies paid out more than yield policies. Switching from revenue to yield policies would have decreased crop insurance payouts by 22 percent in 2012.

- Crop insurance overcompensated farmers. In many cases farmers who had revenue insurance actually had higher revenues than if there had not been a drought.

- Taxpayers could have provided farmers with a secure floor under their finances for less than half of what their crop insurance cost.

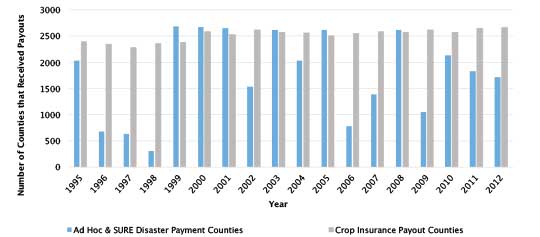

Ad hoc disaster payments only went to producers in those counties that were seen to have suffered a disaster because of bad weather in a particular year. In contrast, crop insurance policies generated payouts year after year and in far more counties than disaster payments did (Figure 2).

Figure 2: Crop insurance payouts go to counties year after year.

Source: EWG, from 2012 Farm Subsidy Database and USDA Risk Management Agency, Summary of Business Reports and Data.

The number of counties eligible for disaster assistance exceeded those eligible for crop insurance payouts in six years between 1995 and 2008 before major ad hoc disaster payments ended. The number of counties that received ad hoc disaster payments varied widely over the period, apparently in response to weather. Only 309 counties got disaster payments in 1998 compared to 2,687 in 1999. In contrast, the counties generating crop insurance payouts varied hardly at all – from 2,277 counties in 1997 to 2,610 in 2002.

Between 1995 and 2012, only 37 counties received an ad hoc disaster or SURE payment every single year. However, 1,943 counties received a crop insurance payout every year- 18 years in a row. The number of counties that received an ad hoc disaster or SURE payment varied widely from year to year, while the number of counties getting crop insurance payouts held steady year after year.

Environmental Consequences

Swapping crop insurance for ad hoc or supplementary crop disaster assistance has dramatically increased the cost taxpayers shoulder and transformed legitimate assistance for periodic disasters into an often generous form of annual income support. Adding salt to the wound, crop insurance actually exacerbates rather than reduces the environmental consequences of disaster payments.

Cultivation of High-Risk and Marginal Land

Critics of disaster payments claim they expanded the cultivation of high-risk and marginal land. But many studies affirm that crop insurance also increases the amount of high-risk and marginal land in production. A 2001 study from researchers at the University of California, Berkeley, concludes that “under reasonable conditions, subsidized crop insurance creates incentives to utilize greater quantities of marginal quality land.”

In February 2015, the Government Accountability Office investigated whether crop insurance premiums cover the cost of losses on high-risk land. Their findings were stunning. In aggregate, farmers were actually making money by buying crop insurance policies because payouts regularly exceeded farmer paid premiums. Worse yet, for farmers in high-risk areas, every dollar of crop insurance premiums brought an average of $1.97 in net gains. Meanwhile, farmers in low-risk counties made a profit of 87 cents for every dollar paid for premiums.

Crop insurance ensures farmers can still make money even when they plant on risky and environmentally sensitive land. Moreover, crop insurance payouts were even larger in high- risk states and counties than were disaster payments.

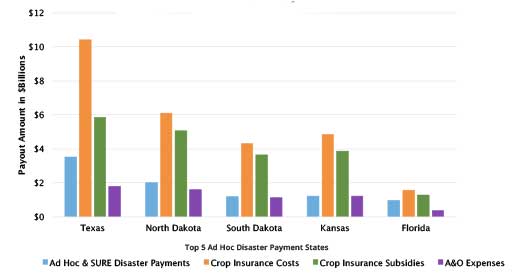

Farmers in Texas, North Dakota, South Dakota, Kansas and Florida received 48 percent of all ad hoc disaster payments and SURE program payments between 1995 and 2012. Crop insurance costs were just as concentrated – these five states made up 42 percent of total net crop insurance costs. In fact, premium subsidies alone were larger than disaster payments in all 5 states.

Administrative and operating expenses were almost as high as disaster payments in North Dakota, South Dakota and Kansas (Figure 3). Total ad hoc and SURE disaster payments to these five states were $8.9 billion, while crop insurance costs were three times as large at $27.2 billion and premium subsidies were twice as large at $19.7 billion.

Figure 3: Crop insurance costs were much larger than disaster payments in the five main ad hoc disaster payment states.

Source: EWG, from 2012 Farm Subsidy Database

The concentration of disaster payments, crop insurance costs and crop insurance payouts was even more striking for the 35 counties that got the most ad hoc disaster and SURE payments. From 1995 through 2012 these 35 counties made up 15 percent of ad hoc disaster and SURE payments, 11 percent of total crop insurance costs and 10 percent of total crop insurance payouts. Disaster payments to the top 35 counties were $2.7 billion while crop insurance costs were $7 billion and crop insurance payouts were $8.6 billion. Over those 18 years, only in 2005 were net crop insurance costs for the top 35 counties smaller than ad hoc disaster and SURE payments.

In 2013, EWG’s “Going, Going, Gone!” report found that between 2008 and 2012 at least 2,500 wetland acres were converted to cropland in 13 of the top 35 disaster payment counties. Thirteen counties (some the same as for wetland conversion and some different) out of the top 35 had at least 2,500 acres of highly erodible land converted to cropland. Disaster payments and crop insurance payouts both encouraged farmers to increase the number of high-risk and marginal acres they farmed.

Prevented Planting

In the 1970s, the disaster payment program largely consisted of payments for low crop yields and prevented planning. These provisions paid farmers if drought or irrigation problems kept them from planting their crops or resulted in low crop yields.

Prevented planting payments were made through the disaster payment program from 1973 through 1981, and were much lower than payments for low crop yields. In the 1974 disaster program, for example, prevented planting payments totaled $35 million while low-yield payments were $522 million. The Federal Crop Insurance Act of 1980 essentially moved the prevented planting provision from the disaster payment program to the crop insurance program.

In the years following the 1980 act, farmers were not entitled to a prevented planting disaster payment if they were eligible for crop insurance. Farmers could only receive a prevented planting payment through ad hoc disaster assistance if the secretary of Agriculture deemed it necessary, or if they were not eligible for crop insurance. In 2008, when major ad hoc disaster legislation stopped and the replacement disaster programs for livestock were set up, prevented planting payments were made exclusively through crop insurance. Currently, the only prevented planting payments that are made through a disaster program are those made through the noninsured crop disaster assistance program to farmers who are not eligible for crop insurance.

In April 2015, EWG released an analysis of the costs of the prevented planting program between 2000 and 2013. We found that prevented planting payments during this time amounted to $8 billion nationwide. Most of these payments were concentrated in the Prairie Pothole region of North and South Dakota. The 195 counties in this region received $4.9 billion in prevented planting payments from 2000 through 2013.

Switching from disaster payments to crop insurance clearly did not solve the prevented planting “problem” that critics associated with disaster payments. Worse yet, prevented planting payments under the crop insurance program are so large and so frequent they encourage farmers to plow out seasonal wetlands in what is considered the most important remaining wetland complex in North America.

Adverse Selection and Moral Hazard

Another important criticism of disaster payments in the 1970s and 80s was that they encouraged farmers to behave in ways that resulted in adverse selection and moral hazard.

- Adverse selection is when a farmer who is buying crop insurance has more information than the seller of the insurance. For example, a farmer may know that one of his fields is risky when used for growing corn, but the federal crop insurance program does not account for the greater riskiness and sets premiums at the same price as for other, less-risky farmers.

- Moral hazard is when a farmer engages in riskier behavior after receiving crop insurance. For example, a farmer may use a different cropping pattern, such as growing corn on corn, after receiving insurance because he would be insured if he received lower yields.

Subsidizing crop insurance was seen as a way to alleviate adverse selection and moral hazard, but research shows that crop insurance causes, if not worsens, these problems. Study after study has shown that adverse selection and moral hazard are very prevalent in the crop insurance program. A 1995 paper from the American Enterprise Institute described the pervasiveness of adverse selection and moral hazard within the crop insurance program, saying that many analysts “view adverse selection as the most significant problem affecting the actuarial soundness of the federal crop insurance program.”

Conclusion

The Federal Crop Insurance Program could and should be a safety net farmers can depend on for help when they suffer a potentially crippling loss because of bad weather. The current program has strayed from that kind of safety net. EWG’s analysis of how crop insurance performed during the 2012 drought – a real disaster – shows just how little the program resembles a safety net when bad weather strikes. The insurance payouts are so large and so frequent and the revenue guarantees so generous, that the program now operates more like an income support program than a safety net.

If crop insurance can return to its roots by concentrating on protecting farmers from natural disasters instead of supporting farmer income, taxpayers will save a great deal of money while still providing farmers with a suitable safety net and reducing the number of environmentally sensitive acres that are farmed.